Introduction

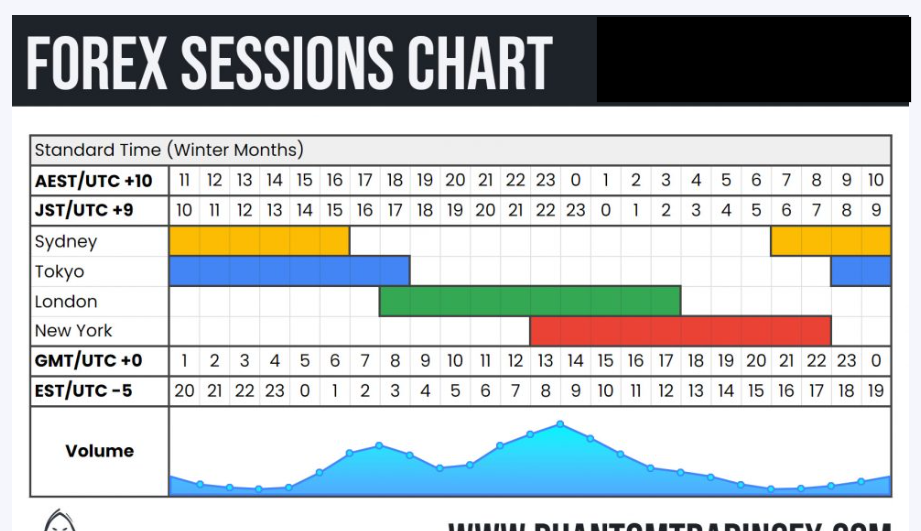

Understanding Forex market hours is essential for any trader looking to maximize their success. The Forex market operates 24 hours a day, five days a week, allowing traders around the world to engage in currency trading at any time. However, not all trading hours are created equal. The market’s activity fluctuates throughout the day, with certain periods offering higher liquidity and volatility, while others are relatively quiet.

Knowing when the market is most active can significantly impact your trading strategy. By aligning your trades with the most favorable market hours, you can increase your chances of capturing profitable opportunities and avoid periods of low activity that may lead to less predictable outcomes.

In this guide, we’ll explore the different Forex market hours, the impact of time zones, and how to leverage this knowledge to enhance your trading performance

What Are Forex Market Hours?

Forex market hours refer to the specific times during which participants can trade currencies across the globe. Unlike traditional stock markets, the Forex market operates 24 hours a day, five days a week, due to the different time zones of major financial centers around the world. This continuous trading environment offers traders the flexibility to enter and exit positions at any time, making it one of the most accessible markets.

The Forex market is divided into four main trading sessions: Sydney, Tokyo, London, and New York. Each session corresponds to the business hours of the respective financial hub, creating a global network of trading activity that never sleeps. Understanding these market hours is crucial for traders, as each session has its own characteristics and levels of market activity.

The Four Major Forex Trading Sessions:

- Sydney Session: The Forex trading day begins with the Sydney session, which is quieter but sets the tone for the Asian markets. This session typically has lower volatility, making it ideal for traders who prefer a more stable environment.

- Tokyo Session: Following the Sydney session, the Tokyo session opens, marking the start of the Asian trading day. The Tokyo session is known for its volatility, particularly in currency pairs involving the Japanese yen.

- London Session: As the Tokyo session winds down, the London session takes over. London is the largest Forex trading center in the world, and this session sees the highest trading volumes. The overlap between the London and New York sessions is particularly significant, as it creates a period of heightened market activity and volatility.

- New York Session: The New York session is the last major session to open, and it overlaps with the London session for a few hours, creating one of the most active trading periods. The New York session also responds to major U.S. economic news releases, which can cause sharp movements in the market.

Why Forex Market Hours Matter

Understanding Forex market hours is crucial for traders because these hours directly impact market activity, liquidity, and volatility. Knowing when the market is most active allows traders to make better decisions, optimize their strategies, and potentially increase their profitability.

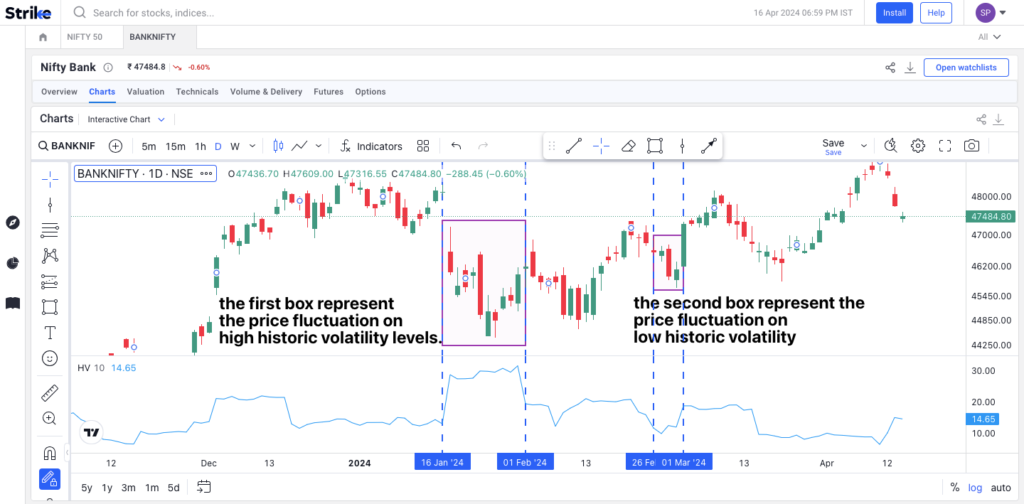

Market Volatility and Liquidity

Forex market hours determine when different financial centers around the world are open, which in turn affects the volume of trades and the market’s liquidity. During certain hours, particularly when two major trading sessions overlap, the market experiences higher volatility. This increased activity can lead to more significant price movements, presenting both opportunities and risks for traders.

For example, the overlap between the London and New York sessions is one of the most active periods in the Forex market. During this time, traders benefit from increased liquidity, tighter spreads, and faster execution of trades. On the other hand, trading during sessions with lower activity, like the Sydney session, might result in less favorable conditions, such as wider spreads and lower liquidity.

Impact of Time Zones

Forex market hours also vary depending on time zones. As the Forex market is a global marketplace, traders from different parts of the world participate according to their local time. This means that the market is constantly moving, but the activity level fluctuates based on which financial centers are open.

Understanding how these time zones affect market hours is essential, especially if you’re trading from a region where the active sessions fall during the night or early morning. Adjusting your trading schedule to align with the most active market hours can help you capitalize on the best trading opportunities.

Strategic Trading

By aligning your trading activities with the most favorable Forex market hours, you can maximize your chances of success. For instance, if you’re a day trader or scalper, trading during high-volatility periods, such as the London-New York overlap, might be more beneficial. Conversely, if you prefer a slower-paced trading environment, focusing on less volatile sessions like Sydney or Tokyo might suit your strategy better.

Best Times to Trade Forex

Choosing the best times to trade Forex can significantly impact your trading success. The Forex market operates 24 hours a day, but not all trading hours offer the same opportunities. Understanding when the market is most active and volatile can help you make informed decisions and optimize your trading strategy.

Most Active Trading Sessions

The most active trading periods occur during the overlap of major trading sessions. The Forex market is divided into four main sessions: Sydney, Tokyo, London, and New York. Among these, the London and New York sessions are particularly noteworthy due to their high trading volumes.

- London Session: The London session is the largest and most active Forex trading session. It accounts for a significant portion of daily trading volume, making it one of the best times to trade. During this session, the market is highly liquid, with tighter spreads and more opportunities for quick price movements.

- New York Session: The New York session is also highly active, especially in the overlap with the London session. This overlap is one of the most volatile periods in the Forex market, with large price swings and high trading volumes. This makes it an ideal time for traders who thrive on volatility.

Session Overlaps

Session overlaps are the periods when two major trading sessions are open simultaneously. These overlaps are often the best times to trade Forex because of the increased market activity and liquidity.

- Tokyo-London Overlap: This overlap occurs when the Tokyo session is closing, and the London session is opening. While it’s less volatile than the London-New York overlap, it still offers good trading opportunities, particularly for pairs involving the Japanese yen and the British pound.

- London-New York Overlap: This is the most significant overlap, where both the London and New York sessions are open. The high volume of trades during this period leads to greater volatility and more trading opportunities. Many traders consider this overlap the best time to trade Forex.

Low-Volatility Periods

While the Forex market is open 24 hours a day, there are periods of lower activity and liquidity. These low-volatility periods typically occur outside of the major trading sessions and overlaps. For example, the hours between the close of the New York session and the opening of the Sydney session are often quieter. During these times, price movements tend to be smaller, and spreads may widen, which can make trading less attractive.

If you prefer a less volatile market, these periods might suit your trading style. However, for most traders looking to capitalize on significant price movements, it’s better to focus on the more active trading hours.

Forex Market Hours by Region

Understanding Forex market hours by region is crucial for traders looking to optimize their trading strategies. The Forex market operates 24 hours a day, five days a week, but the trading activity varies across different regions. Here’s a breakdown of the Forex market hours by key regions:

1. Sydney Session

- Time: 10 PM – 7 AM GMT

- Overview: The Sydney session starts the Forex trading day. While it is less volatile compared to other sessions, it can be important for market news and initial moves.

2. Tokyo Session

- Time: 12 AM – 9 AM GMT

- Overview: As the Tokyo session begins, Asian markets become active. This session is known for increased volatility in pairs involving the Japanese yen and offers significant trading opportunities.

Suggested Image: Map highlighting Tokyo’s timezone with key currency pairs.

3. London Session

- Time: 8 AM – 5 PM GMT

- Overview: The London session is one of the most active trading periods due to the high number of financial institutions. It often overlaps with the Tokyo session, providing more opportunities for traders.

Suggested Image: Graph showing trading volume spikes during the London session.

4. New York Session

- Time: 1 PM – 10 PM GMT

- Overview: The New York session overlaps with the London session for a few hours, creating high liquidity and volatility. It’s the peak trading period for the U.S. dollar and other major currencies.

Trading Overlaps

- Tokyo-London Overlap: 8 AM – 9 AM GMT

- London-New York Overlap: 1 PM – 5 PM GMT

These overlaps are particularly active and offer the best trading opportunities due to the high volume of market participants.

Common Mistakes to Avoid

Avoiding common mistakes in Forex trading is essential for achieving consistent success. Traders, both new and experienced, can fall into several traps that impact their profitability. Here are some key mistakes to watch out for:

1. Overleveraging

- Issue: Using excessive leverage can amplify losses as well as gains. This high-risk strategy often leads to substantial losses when trades move against you.

- Solution: Stick to moderate leverage and ensure you understand the risks involved before increasing it.

2. Lack of a Trading Plan

- Issue: Trading without a well-defined plan can lead to impulsive decisions and inconsistent results. A plan should outline your trading strategy, risk management rules, and objectives.

- Solution: Develop a comprehensive trading plan and follow it consistently.

3. Ignoring Risk Management

- Issue: Failing to use stop-loss orders and proper position sizing can lead to significant losses. Risk management is crucial to protect your capital from unexpected market movements.

- Solution: Implement stop-loss orders and only risk a small percentage of your trading account on each trade.

4. Emotional Trading

- Issue: Letting emotions drive your trading decisions can lead to poor choices, such as chasing losses or overtrading. Emotional trading often results in deviation from your strategy.

- Solution: Maintain discipline and stick to your trading plan. Practice mindfulness techniques to manage stress and emotions.

5. Neglecting Fundamental and Technical Analysis

- Issue: Relying solely on one type of analysis can limit your trading effectiveness. Both fundamental and technical analysis provide valuable insights into market conditions.

- Solution: Use a combination of fundamental and technical analysis to make well-rounded trading decisions.

6. Overtrading

- Issue: Trading too frequently can lead to high transaction costs and increased exposure to market risk. Overtrading often results from impatience or the desire to recover losses quickly.

- Solution: Focus on high-quality trades that meet your criteria rather than trading frequently.

Suggested Image: Graph showing the impact of overtrading on transaction costs.

7. Ignoring Economic News

- Issue: Major economic events and news releases can significantly impact currency prices. Ignoring these events can lead to unexpected market movements.

- Solution: Stay informed about upcoming economic events and incorporate them into your trading strategy.

Conclusion

In conclusion, mastering Forex trading requires a solid understanding of key concepts, strategies, and practices. Here are the main takeaways to help you succeed:

1. Understand Forex Market Hours

- Recognize the different Forex market hours by region to time your trades effectively. Each session—Sydney, Tokyo, London, and New York—offers unique trading opportunities and varying levels of volatility.

2. Avoid Common Mistakes

- Steer clear of frequent pitfalls such as overleveraging, lack of a trading plan, ignoring risk management, emotional trading, neglecting analysis, overtrading, and disregarding economic news. Implement strategies to mitigate these risks and enhance your trading performance.

3. Develop a Robust Trading Plan

- A well-defined trading plan should include clear goals, risk management rules, and strategies for entry and exit. Consistently following your plan helps maintain discipline and focus.

4. Utilize Both Fundamental and Technical Analysis

- Combining fundamental and technical analysis provides a comprehensive view of the market. This approach allows for more informed decision-making and better trade execution.

5. Practice Effective Risk Management

- Implement risk management techniques such as setting stop-loss orders and controlling leverage. Protecting your capital is crucial for long-term success in Forex trading.

Final Thoughts

Achieving success in Forex trading involves continuous learning, adapting to market changes, and avoiding common mistakes. By understanding market hours, developing a solid trading plan, and practicing effective risk management, you set yourself up for more informed and strategic trading decisions..

Incorporate these principles into your trading routine to enhance your performance and work towards achieving your financial goals in the Forex market.

Call to Action

read more on

forexmarket volatility

Forex Factory Uncovered:The Shocking Pros, Cons, and Must-Know Tips for Traders in 2024