What is the Forex Factory Calendar?

The Forex Factory Calendar is a widely used tool among Forex traders, designed to provide real-time information about upcoming economic events and announcements that could impact the currency markets. It’s an essential resource for anyone involved in Forex trading, as it helps traders stay informed about market-moving events and make more educated trading decisions.

Understanding the Basics:

The Forex Factory Calendar is essentially a schedule of global economic events. These events include things like central bank meetings, employment reports, inflation data, and other economic indicators that can influence currency values. By tracking these events, traders can anticipate potential market volatility and adjust their trading strategies accordingly.

How It Works:

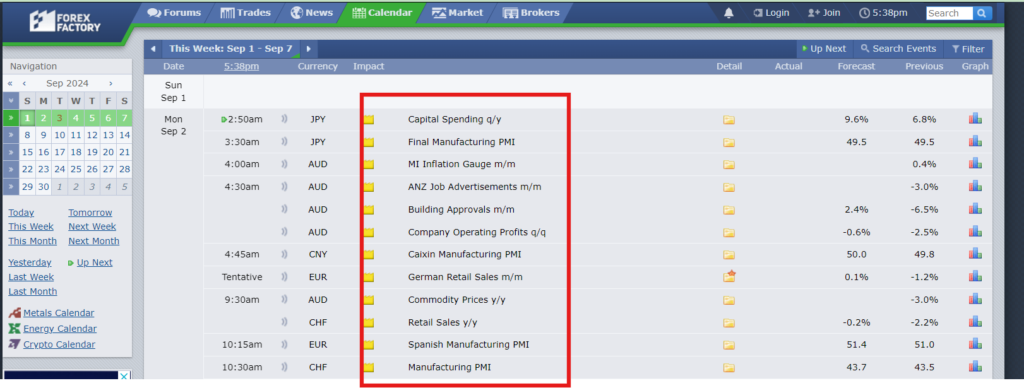

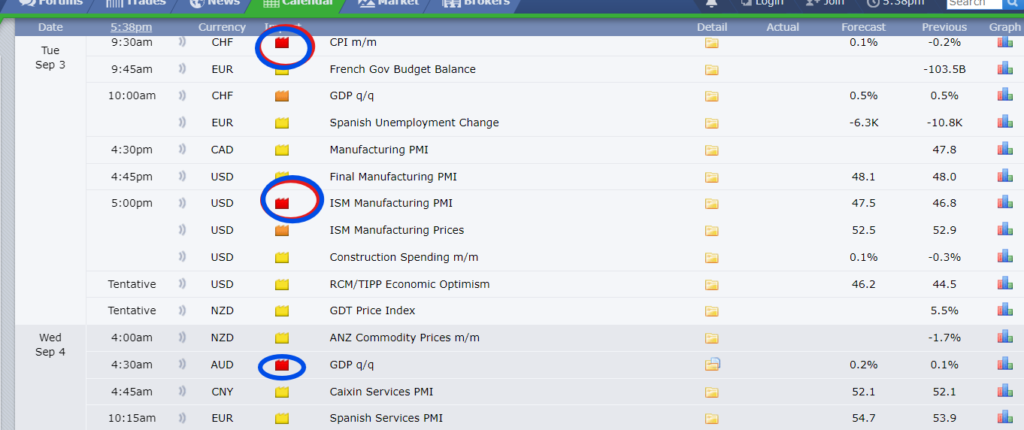

Each event listed on the Forex Factory Calendar is accompanied by important details such as the date, time, currency involved, and the expected level of market impact. The calendar categorizes events using color-coded icons: red for high impact, orange for medium impact, and yellow for low impact. This allows traders to quickly assess which events are most likely to cause significant market movements.

Why It’s Important:

For traders, the Forex Factory Calendar is more than just a list of dates and events. It’s a critical tool for managing risk and planning trades. By knowing when major economic announcements are scheduled, traders can avoid entering positions during periods of high volatility or take advantage of market reactions to these events.

How to Read the Forex Factory Calendar

The Forex Factory Calendar is a powerful tool for traders, but to fully leverage its potential, it’s essential to understand how to read and interpret the information it provides. This guide will walk you through the key elements of the calendar, ensuring you can use it effectively to make informed trading decisions.

Breaking Down the Forex Factory Calendar:

The Forex Factory Calendar is organized into several columns, each providing crucial details about upcoming economic events. Here’s a breakdown of what each column represents:

- Date & Time: This column shows when the event is scheduled to occur. The time is typically displayed in the user’s local timezone, ensuring you know exactly when to expect the event.

- Currency: The currency column indicates which currency pair will be affected by the event. For instance, if the event relates to the U.S. economy, it will impact currency pairs involving the USD.

- Impact: The impact column uses color-coded icons to signify the expected market impact of the event. Red indicates high impact, orange medium impact, and yellow low impact. These icons help traders prioritize which events to focus on.

- Event: This column provides the name of the event or announcement. Common events include interest rate decisions, GDP reports, and employment data releases.

- Actual, Forecast, & Previous

- The actual data or result of the event is displayed here once it’s released.

- Forecast: This shows the market’s expected outcome before the event takes place.Previous: This column lists the data from the last time the event occurred, offering a point of comparison.

Interpreting the Data:

To use the Forex Factory Calendar effectively, you need to understand how to interpret these columns:

- Focus on High-Impact Events: High-impact events (marked in red) are likely to cause significant market movements. Traders should pay close attention to these events, especially if they involve major currencies like the USD, EUR, or JPY.

- Compare Forecast vs. Actual: One of the key strategies in using the Forex Factory Calendar is to compare the forecasted outcome with the actual result. A significant deviation from the forecast can lead to sharp market reactions, presenting trading opportunities.

- Use Historical Data: The previous column allows traders to see what happened the last time a similar event occurred. This historical data can help predict potential market behavior based on past reactions.

Why the Forex Factory Calendar is Essential for Traders

The Forex Factory Calendar is an indispensable tool for traders who want to stay informed about market-moving events. By providing real-time information on key economic announcements, the calendar helps traders make better decisions, manage risk, and capitalize on market opportunities. Here’s why the Forex Factory Calendar is essential for traders at all levels.

1. Staying Ahead of Market Volatility:

The Forex market is highly sensitive to economic events, and unexpected news can cause significant price fluctuations. The Forex Factory Calendar allows traders to anticipate these events, giving them the opportunity to adjust their strategies accordingly. Whether it’s an interest rate decision or a major employment report, knowing when these events are scheduled helps traders avoid unexpected volatility or prepare to take advantage of it.

2. Planning Trades Around Economic Events:

For many traders, timing is everything. The Forex Factory Calendar enables traders to plan their trades around key economic events, ensuring they enter and exit positions at the most opportune moments. For example, a trader might choose to close a position before a high-impact event to avoid potential losses or enter a trade just before the event to capitalize on market reactions.

3. Enhancing Risk Management:

Risk management is a crucial aspect of successful trading. The Forex Factory Calendar plays a vital role in helping traders manage risk by highlighting when major events are likely to occur. By being aware of these events, traders can set appropriate stop-loss orders, adjust their leverage, or decide to stay out of the market entirely during particularly volatile periods.

4. Improving Trading Strategies:

The data provided by the Forex Factory Calendar can be integrated into various trading strategies. For instance, traders who use fundamental analysis rely heavily on economic indicators to inform their decisions. By using the calendar to track upcoming announcements, these traders can make more informed predictions about currency movements. Even technical traders can benefit by understanding when to avoid trading during periods of potential market disruption.

5. Gaining a Competitive Edge:

In the fast-paced world of Forex trading, having access to accurate and timely information is key to gaining a competitive edge. The Forex Factory Calendar provides traders with a reliable source of information, allowing them to react quickly to news and events that impact the market. This can make the difference between a profitable trade and a missed opportunity.

Tips for Using the Forex Factory Calendar Effectively

Tips for Using the Forex Factory Calendar Effectively

The Forex Factory Calendar is a powerful tool that can significantly enhance your trading strategy—if you know how to use it effectively. By following these tips, you can make the most out of the calendar, improve your decision-making process, and ultimately boost your trading performance.

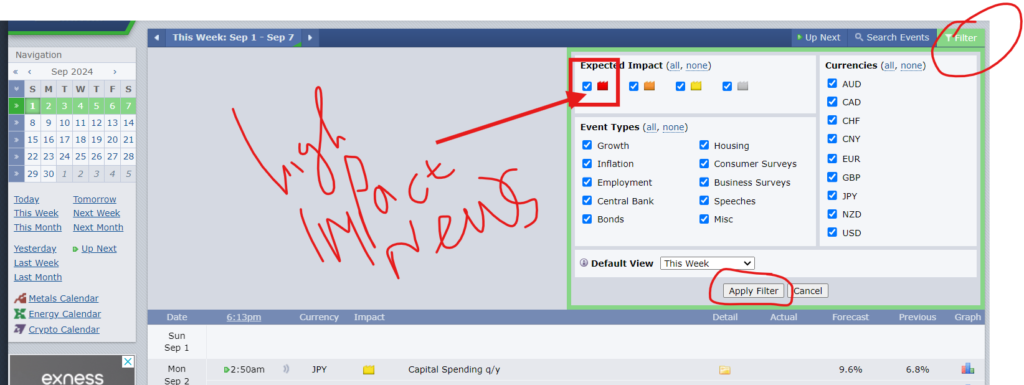

1. Customize the Calendar to Fit Your Trading Style:

One of the first steps to using the Forex Factory Calendar effectively is to customize it according to your trading preferences. The calendar allows you to filter events by currency, impact level, and event type. For example, if you mainly trade EUR/USD, you can filter the calendar to show only events that are likely to affect the Euro or the U.S. dollar. This helps you focus on the most relevant information, reducing distractions and making your analysis more efficient.

2. Set Alerts for High-Impact Events:

High-impact events are often the ones that lead to significant market movements. Setting alerts for these events ensures you won’t miss out on critical moments that could influence your trades. You can use the alert feature on the Forex Factory Calendar to receive notifications via email or directly on your trading platform. This allows you to prepare in advance, whether that means adjusting your positions or staying on the sidelines.

3. Combine the Calendar with Technical Analysis:

While the Forex Factory Calendar provides valuable fundamental data, it’s important to combine this with technical analysis to get a complete picture. Before a major event, check key support and resistance levels on your charts. Understanding where price action might react in conjunction with upcoming economic events can help you refine your entry and exit points, leading to more precise trading decisions.

4. Review the Calendar at the Start of Each Trading Day:

Making it a habit to review the Forex Factory Calendar at the beginning of each trading day can give you a strategic advantage. By knowing what events are scheduled, you can plan your trading day around these events, setting up potential trades or avoiding the market during particularly volatile times. This proactive approach can help you avoid surprises and stay focused on your trading plan.

5. Use the Calendar to Backtest Trading Strategies:

The historical data available on the Forex Factory Calendar can be a valuable resource for backtesting your trading strategies. By analyzing how the market reacted to past events, you can identify patterns or correlations that might inform your future trades. This can be particularly useful for traders who base their strategies on fundamental analysis or for those looking to refine their approach to trading around news events.

Common Mistakes to Avoid When Using the Forex Factory Calendar

Common Mistakes to Avoid When Using the Forex Factory Calendar

The Forex Factory Calendar is an invaluable tool for traders, but like any tool, it’s only as effective as the person using it. To get the most out of the calendar and avoid potential pitfalls, it’s important to be aware of some common mistakes that traders often make. By sidestepping these errors, you can use the Forex Factory Calendar more effectively and enhance your trading strategy.

1. Ignoring Low-Impact Events:

One of the biggest mistakes traders make is focusing solely on high-impact events (marked in red) and completely ignoring medium (orange) and low-impact (yellow) events. While high-impact events are more likely to cause significant market movements, medium and low-impact events can also trigger volatility, especially when the market is already sensitive. By dismissing these events, traders might miss out on valuable insights or face unexpected market reactions.

2. Overreacting to Every Event:

Another common error is overreacting to every event listed on the Forex Factory Calendar. Not all events will have the expected impact, and sometimes the market might have already priced in the outcome. Reacting impulsively to each event without considering the broader market context can lead to poor trading decisions. It’s crucial to assess each event within the overall market environment and your trading strategy.

3. Relying Solely on the Calendar for Trading Decisions:

The Forex Factory Calendar is a great resource, but relying on it exclusively without considering other factors can be a mistake. The calendar provides important fundamental data, but it should be used in conjunction with other analysis tools like technical analysis, sentiment analysis, and your own trading strategy. Over-reliance on the calendar might lead to missed opportunities or entering trades without a comprehensive understanding of the market.

4. Failing to Account for Time Zone Differences:

The Forex Factory Calendar displays event times based on your local time zone, but it’s easy to overlook this detail, especially if you’re trading across multiple time zones. Not accounting for time zone differences can lead to confusion and missed events. Always double-check the time settings to ensure you’re looking at the correct schedule for your trading session.

5. Not Updating the Calendar Regularly:

Market conditions and event schedules can change, and the Forex Factory Calendar is updated in real-time to reflect these changes. A common mistake is failing to refresh the calendar throughout the trading day, which can result in missing updated information or newly added events. Make it a habit to periodically refresh the calendar to ensure you have the most current data.

conclusion

The Forex Factory Calendar is an essential tool for any trader looking to navigate the complexities of the Forex market with confidence. By providing real-time information on economic events and announcements, the calendar helps traders stay informed, anticipate market movements, and make more strategic decisions.

Whether you’re a beginner or an experienced trader, understanding how to effectively use the Forex Factory Calendar can give you a significant edge. From planning trades around key economic events to enhancing your risk management strategies, the calendar offers invaluable insights that can improve your overall trading performance.

However, it’s important to use the Forex Factory Calendar as part of a broader trading strategy. Avoid common mistakes like overreacting to events or relying solely on the calendar without considering other forms of analysis. By combining the calendar with technical analysis, sentiment analysis, and a solid trading plan, you can maximize its benefits and minimize risks.

Incorporating the Forex Factory Calendar into your daily routine can transform how you approach the market, allowing you to trade more effectively and with greater precision. Start using this powerful tool today, and take your trading to the next level.

READ MORE

Forex Factory Uncovered:The Shocking Pros, Cons, and Must-Know Tips for Traders in 2024